I’m often a bit of a broken record with my clients on one point, and that is trying to instil that they use up any tax perks available as the foundations of their robust financial plan. I can often be heard repeating ‘What HMRC gives with one hand they will take away from you with the other’ and it is essential to annual use up any beneficial subscriptions or allowances they offer to balance out the effects of taxes in our lives.

One very simple tax perk I often encounter being overlooked or mis understood by savers is the ISA. Misconceptions I often encounter are that it isn’t applicable to higher or additional rate tax payers (incorrect), not available at retirement or perhaps not available if you are a non-tax per (again, both incorrect).

Actually, quite simply, any UK resident adult can apply for an ISA (there are some more quirky versions outlined later) and take advantage of this savings ‘Brucie Bonus’ from HMRC.

So, what are its features and benefits?

- An ISA is free from income and gains in the hands of the investor – so it can grow very tax efficiently

- It doesn’t need to be declared to HMRC by the investor – the ISA provider notifies HMRC of your subscriptions.

- The gains and income are not part reported for self-assessment – an ISA can therefore be a great tax free supplement to retirement income for example.

- There is generally no minimum age to make withdrawals or a tie in period – unlike a pension which restricts access to age 57

- Any band of tax payer can apply for it.

- It can be part of a well executed financial plan – a ‘Bed and ISA’ process each tax year with your financial adviser can ensure any taxable investments you hold are moved across and shielded within your ISA account.

- Finally –‘use it or lose it each tax year’. Unlike a pension, subscriptions cannot be carried forward unlike a pension.

Can I move ISA providers?

Yes, ISAs can be transferred between providers but ensure this is completed via an ISA transfer to maintain the accrued subscriptions. If the money is simply withdrawn out of the ISA wrapper the ISA status will be lost.

Can I replace withdrawals?

Not unless you hold a ‘flexible’ type ISA and there are particular rules for which years subscriptions are withdrawn and then replaced.

What happens to my ISA on death?

It becomes part of your Estate and could be liable to inheritance tax. However, your civil partner or spouse can apply for an ‘additional permitted subscription’ to use your accrued ISA allowances in addition to their own (the ISA subscription value is not lost) and the money within your ISA can instead be passed to any beneficiary.

Which ISA is right for me?

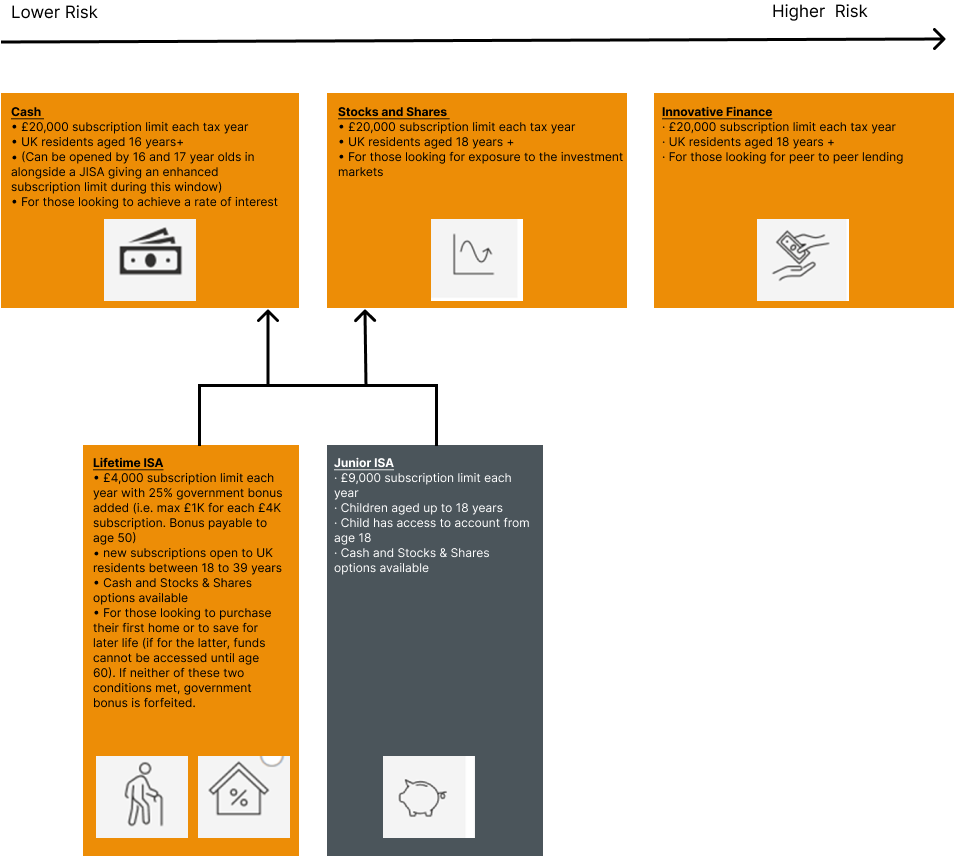

The £20,000 ISA limit for adults can utilise combinations of the available ISAs to them as detailed below subject to the ‘1 ISA per type per tax year’ rule. Current new subscriptions available are highlighted below:

Contact us on 0330 320 9280, email info@cravenstreetwealth.com or complete our online enquiry form to discuss the right investments for you.

The content of this article is for information only and does not constitute formal financial advice. This material is for general information only and does not constitute investment, tax, legal or other forms of advice.

References to legislation and tax is based on our understanding of United Kingdom law and HM Revenue & Customs practice at the date of publication. These may be subject to change in the future. Tax rates and reliefs may be altered. The value of tax reliefs to the investor depends on their financial circumstances. No guarantees are given regarding the effectiveness of any arrangements entered into on the basis of these comments.

You should not rely on this information to make, or refrain from making any decisions. Always obtain independent, professional advice for your own particular situation.

Craven Street Financial Planning Limited is authorised and regulated by the Financial Conduct Authority

Production

Production