I am commonly asked questions such as “How much do I need to save to fund my retirement?”, “How much should I be paying into my pension?”, “Is my pension pot at a good level” and “What will my pension provide me with when I retire?”

The answer however is not as simple as it may seem and all depends on a number of factors such as:

- Your desired retirement age?

- Is this in line with State Pension Age or later/earlier?

- What your retirement expenditure will likely be?

- It could be beneficial to take your expenditure now and remove as many outgoings i.e. mortgage.

- Then factor in any additional costs, such as holidays or a new vehicle

- Do you intend to use income drawdown, or purchase an annuity?

- In income drawdown your pension remains invested and you can drawdown income as and when you need it. The danger however is that you could draw too much and run out of funds

- With an annuity you pass the pension capital to an insurance company who provide an income for the remainder of your lifetime. Spouses annuities can be added at an extra cost.

- The affordability of saving the maximum now into pensions to achieve the retirement you wish later on?

- Income tax relief should be received on your personal pension contributions

- Do bear in mind that the funds will likely be inaccessible until age 55 (increasing to age 57 from 2028) except in certain prescribed circumstances

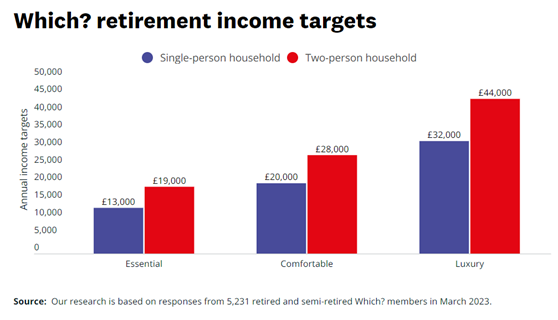

The below average retirement expenditure graph is from Which? magazine and can be accessed here.

Most desire at least a ‘comfortable’ retirement, so according to the research performed by Which? would require provisions for at least £28,000 gross expenditure. A more luxurious retirement typically consisting of larger holidays, home improvements and a new car frequently, then a two person household will reportedly require £44,000 gross annually.

Ensure you check you are ‘on track’ to receive the full state pension by performing a forecast.

This full entitlement is currently £10,600, so a couple could achieve a retirement income of £21,200 annually from the state alone. This could cover essential expenditure, but saving personally into pensions too could result in a better lifestyle and more choices when you retire.

Using these different lifestyle definitions and figures from Which? we have calculated the likely value of pension funds required. We have assumed that any tax free payment is made (i.e. 25% of the pension fund) to provide a cash buffer for any emergencies.

| Lifestyle | Annual Net Expenditure* | State Pension** | Private Gross Pension income | Private Pension Fund size required |

| Essential | £13,000 | £10,600 | £2,510 | £73,500 |

| Comfortable | £20,000 | £10,600 | £11,266 | £313,000 |

| Luxury | £32,000 | £10,600 | £26,300 | £734,000 |

*Based on a single person household

**Assumes full state pension is accrued (23/24 figures)

Assumptions:

- Full tax free cash is taken and an annuity is purchased

- You are in good health

- Aged 67

- Annuity includes a 50% spouses income and a 10 year guaranteed period

- Annuity Increases by 3% a year

- The personal allowance is £12,570 (23/24 tax year)

Please note that these annuity rates were correct on 28th June 2023. They are not guaranteed and will fluctuate both up and down.

Some clients wish to retire earlier than their State Pension Age. If this is the case for you, then saving additional amounts into private pensions is key to planning your retirement income. You may decide to retire from your current role and phase into your retirement by opting to carry out a different part time role. This can sometimes bridge the gap between semi-retirement and your state pension being paid.

It is however not all about pensions. Your retirement income can be funded from other assets such as a buy to let property, an investment portfolio or simple savings accrued in the bank. We can prepare a financial plan using all of your assets to ensure that your needs can be met.

To understand how to best achieve your desired retirement please contact us on 0330 320 9280, email info@cravenstreetwealth.com or complete our online enquiry form.

The content of this article is for information only and does not constitute formal financial advice. This material is for general information only and does not constitute investment, tax, legal or other forms of advice.

References to legislation and tax is based on our understanding of United Kingdom law and HM Revenue & Customs practice at the date of publication. These may be subject to change in the future. Tax rates and reliefs may be altered. The value of tax reliefs to the investor depends on their financial circumstances. No guarantees are given regarding the effectiveness of any arrangements entered into on the basis of these comments.

You should not rely on this information to make, or refrain from making any decisions. Always obtain independent, professional advice for your own particular situation.

Craven Street Financial Planning Limited is authorised and regulated by the Financial Conduct Authority.

Production

Production