The news does feel all doom and gloom sometimes, doesn’t it? Rising energy prices and food bills. Inflation. Increased mortgage costs. Strikes. Travel plans out of kilter, either from a delay in receiving your passport, or trying to locate your lost luggage!

Maybe they’re not all of the same level of importance, but it is hard not to get caught up in the turmoil sometimes.

The financial markets have experienced some dramatic outcomes, even to those with – what some might consider to be – a conservative approach to investing.

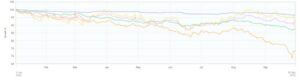

As Chart 1 shows, if you were invested in a 60/40 portfolio of equities and bonds, your investment would be down more than 22% for the first nine months of this year, the largest decline for this asset allocation in 40 years.

Chart 1

Source: Collidr / Bloomberg

Imagine, a portfolio with a 40% allocation to bonds down more than 22%!

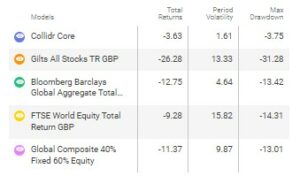

With inflation in the UK continuing to rise, the bond markets have experienced a turbulent 2022. Gilts (UK government bonds) have declined by nearly 31% and almost £1.5 trillion has been wiped off the entire UK bond market[1].

Chart 2

Source: Collidr / Bloomberg

Who wouldn’t feel anxious in this environment?

You may well be assessing your financial situation and wondering what you need to do to get through this.

It is important to keep these events in perspective, to not let your emotions impact your decision-making, and to remain positive. To focus on the goals in your life that are most important to you.

When it comes to your investments and making sure you achieve your objectives, there are some suggestions below that might help:

- Plan

Like most things in life, financial success rarely occurs overnight but usually involves some degree of planning. When it comes to achieving your investment goals – whether it is funding a comfortable retirement, saving for your dream home, or making sure your family is looked after – we believe that developing a plan is crucial.

In turn, long-term financial well-being is often achieved by following a rigorous and disciplined investment approach. Financial planning and adhering to a sound investment strategy go hand in hand.

Without a plan, investors may be prone to decision-making based unduly on emotions, while getting caught up in the market ‘noise’ around them. Following a sound investment discipline reduces this bias.

Equally, without focus and a regular review of your goals, the best laid plans can sometimes unravel. The world is constantly changing, and sometimes you will need to adapt in order to realise your objectives. Based on the previous example of the bond markets, a strong investment strategy will take into account these evolving market dynamics and adapt appropriately.

To start, you could look at your present situation and set some reasonable goals, creating a plan based on your unique circumstances and preferences. For your investment strategy, you need to consider your appetite for investment risk, and your capacity to absorb investment losses. We would have these important conversations with you, the outcome of which helps us to determine the most suitable asset allocation for you as part of our portfolio construction process.

- Invest

Generally speaking, the ideal asset allocation will be based on your overall investment objectives, your tolerance to risk, and your capacity for loss. No doubt you have heard the saying – ‘there is no reward without risk’. That’s especially true when it comes to investing. For many, a basic approach might entail selecting the right balance of equities, bonds and cash to hold.

But as the previous example of the 60/40 portfolio shows, sometimes you need to look beyond these basic asset classes (and the underlying investment products to use to obtain that exposure). Achieving long-term financial success means not only accepting a trade-off between risk and reward, but understanding the historical patterns of equities, bonds, as well as other asset classes and strategies, so as to manage risk prudently and select the right investments for your portfolio.

Chart 3 shows the performance of the Core funds (defensive section) within our Wealth Preservation portfolios over 2022 to the end of September (Collidr Core).

Chart 3

Source: Collidr / Bloomberg

- Focus

We believe that behavioural investing is the secret weapon in investment management. It is our core belief that everyone should understand the fundamental (and sometimes flawed) role that human behaviour plays in the investment process if they hope to achieve long-term success.

Why is it important?

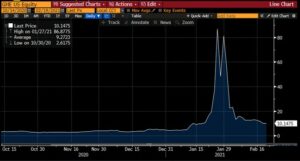

Because human behaviour, for instance emotions, can affect how we make investment decisions, and often lead us to make bad decisions resulting in poor outcomes. Common mistakes include buying funds with good recent performance without considering the risk involved, in the mistaken belief that the strong performance will continue; or being afraid to invest in the market after suffering a recent loss. The example below shows the spike in the price of GameStop, a retail stock for electronic games in the US, which rallied strongly based on pure speculation posted on the social media site Reddit, only to collapse back to previous levels. This is a perfect example of herding behaviour, where people follow the behaviours of others.

Chart 4

Source: Bloomberg

Research has shown that these human traits are sometimes difficult to overcome, even for professional investors. Our philosophy flows into the tools we have developed to create a disciplined, rules-based system.

Whether it is evaluating and monitoring exposures to asset classes or strategies, analysing how assets, portfolios or funds should behave in a whole range of market conditions, or mathematically optimising portfolios using multiple investment techniques, there are many tools that we use to help construct our portfolios.

- Assess

It is important to keep the markets in context – they will always rise and fall. To be successful, one needs to continually manage risk appropriately, as well as look for investment opportunities. Follow and maintain a long-term discipline.

Some investors may find themselves making impulsive decisions at times or, conversely, finding themselves afraid to implement an investment strategy required to achieve their long-term objectives.

The asset allocation decision is a critical element in achieving one’s investment objective, but it is only part of the process. Knowing how to invest through varying market environments, the asset classes, investment strategies or trading techniques to deploy, in the long-term, will help protect and enhance overall market returns.

So, try not to lose sleep.

It is important to keep things in perspective, to avoid panicking, and adhere to a long-term investment discipline instead, so as to help you through these and, no doubt, other periods of market uncertainty ahead.

To discuss investing or an existing investment portfolio please contact us on 0330 320 9280, email info@cravenstreetwealth.com or complete our online enquiry form.

The content of this article is for information only and does not constitute formal financial advice. This material is for general information only and does not constitute investment, tax, legal or other forms of advice.

References to legislation and tax is based on our understanding of United Kingdom law and HM Revenue & Customs practice at the date of publication. These may be subject to change in the future. Tax rates and reliefs may be altered. The value of tax reliefs to the investor depends on their financial circumstances. No guarantees are given regarding the effectiveness of any arrangements entered into on the basis of these comments.

You should not rely on this information to make, or refrain from making any decisions. Always obtain independent, professional advice for your own particular situation.

Craven Street Financial Planning Limited is authorised and regulated by the Financial Conduct Authority

Production

Production