With the new tax year just around the corner, the countdown is on to use up your allowances before April.

Whilst there are other means you can use to try and potentially reduce your tax bill, a possible and simple way to do this is via pension contributions and the use of Pension carry forward.

The maximum pension contribution, on which tax relief can be claimed in a tax year, is currently £40,000 gross – this includes both personal and employer contributions.

For higher earners, you may be impacted by the tapered annual allowance meaning that if your income is more than £240,000 from all sources, then the amount that you can pay into a pension will be reduced.

How can I take advantage of this?

You must use your current tax years annual allowance before going back. Once you have used your current years allowance, you can then carry forward unused annual allowances from the three previous tax years, starting with the earliest which currently could be 2019/20.

This could mean that you may be able to make a pension contribution of up to £160,000 (including tax relief) in the current tax year.

To qualify you must have held a qualifying pension plan in the years for which you are looking to carry forward unused relief.

Any contribution cannot exceed 100% of your salary in the tax year in question therefore it is imperative that you have your gross income details for these years – you can usually get this information from HMRC if you do have this.

Alternatively, your employer/company could potentially make this contribution instead but there will be certain criteria that needs to be met before this can be done.

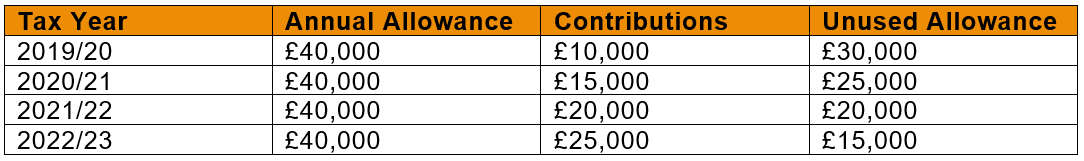

As an example of this allowance working in practice, please see below:

The total unused allowance is therefore £90,000. Subject to the above criteria being met, this sum may be able to be added to your pension policy including tax relief and, if you are a higher or additional rate taxpayer, you may be able to claim relief back via submitting a tax return.

If you only need to use some of your unused annual allowance from a tax year, you can use the rest in a future year.

Contact us on 0330 320 9280, email info@cravenstreetwealth.com or complete our online enquiry form to establish what allowances may be available to you.

The content of this article is for information only and does not constitute formal financial advice. This material is for general information only and does not constitute investment, tax, legal or other forms of advice.

References to legislation and tax is based on our understanding of United Kingdom law and HM Revenue & Customs practice at the date of publication. These may be subject to change in the future. Tax rates and reliefs may be altered. The value of tax reliefs to the investor depends on their financial circumstances. No guarantees are given regarding the effectiveness of any arrangements entered into on the basis of these comments.

You should not rely on this information to make, or refrain from making any decisions. Always obtain independent, professional advice for your own particular situation.

Craven Street Financial Planning Limited is authorised and regulated by the Financial Conduct Authority.

Production

Production