The State Pension has its roots in the Old Age Pensions Act of 1908 – the first UK pensions legislation – which was a means tested (and interestingly, behaviour tested) payment to the over 70s, with a full entitlement being 5 shillings a week. Prior to this, the Poor Law in force in the 19th Century made very little provision for retirement with continued employment being the primary source of support for everyone.

What is the new State Pension?

Over 100 years later, legislation has thank fully changed to the State Pension (in its latest incarnation, the ‘new State Pension’) we are familiar with today.

The state pension is money you may be able to receive from the Government to help fund your retirement.

Your state pension is funded through your National Insurance Contributions (NICs) paid via your employment earnings. National Insurance contributions are used by the Government to fund various payments and benefits including your State Pension.

Example payslip showing employee and employer NICs

You will need a full 30 years NIC history to get the full state pension and 10 years for any entitlement at all. NIC credits may also be available to those who are not employed – those claiming Child Benefit for example, may also be credited with NICs until their youngest child is 12, even if they are not earning.

Remember, NICs are only paid by you until State Pension age – you no longer need to make these contributions if you continue to work thereafter.

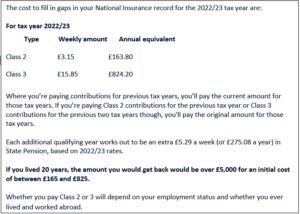

If you do not have a full State Pension entitlement, it can sometimes be topped up by purchasing additional NICs for missing years (if eligible), usually covering the 6 previous tax years. Although you may have missing years, it’s always a good idea to check that paying these missing years will actually increase your State Pension payments. Also, bear in mind that if you are in ill health you may not get good value by increasing your entitlement over the longer term – its always worth obtaining further information on this via organisations such as Citizens Advice or Help the Aged, for example to help with your decision.

(Source: Money Helper.org).

How do I receive the new State Pension?

If eligible, the Department for Work and Pensions will pay this to you at your State Pension age which is gradually increasing to 67 for men and women by 2028 (you can check yours here https://www.gov.uk/state-pension-age). Remember, you have to apply for the new State Pension either online or via telephone (https://www.gov.uk/new-state-pension/how-to-claim. Once you have applied you will receive a letter from the Department of Work and pensions advising of your entitlement

Department for Work and Pensions can provide you with a State Pension forecast via https://www.gov.uk/check-state-pension.

What is the ‘triple lock’ guarantee and why is it so valuable?

The full new State Pension is £185.15 per week and usually paid 4 weekly in arrears. Based on the 365.25 days in year on average, this equates to a tax-free payment of around £9,661 per year. If you receive any other taxable income, remember the State Pension utilises your Personal Allowance first.

The 2010 Budget introduced the ‘Triple Lock Guarantee’ – a promise which has been critical for those in receipt of the State Pension to ensure their income can keep up with that of the working population.

The ‘Triple Lock Guarantee’ ensures that every year the state pension rises in April by the highest of the previous September’s inflation (as measured by the Consumer Prices Index), wage growth or 2.5%.

In other words, if average earnings were to increase by 4 per cent, the state pension would also increase by 4 per cent. But if neither average earnings nor inflation increase by more than 2.5 per cent, the state pension still rises by 2.5 per cent.

Therefore, if wage growth and price growth remain low, the state pension increases actually beat inflation – as has happened a lot in the years since the triple lock was put in place.

Remember, the Government takes on all of the risk with delivering this guaranteed increasing payment to retirees. Unlike personal pension provision, there is no investment performance, charges, investment risk, or fund depletion concerns for the retiree in receipt of the new State Pension.

In contrast, if you were to purchase an increasing lifetime annuity today paying you £9,661 gross per annum, increasing by 3% a year (the Triple Lock is not a feature of purchased pension benefits) you may need to purchase this with around £200,000 in pension value (based on standard rates) at time of writing.

Contact us on 0330 320 9280, email info@cravenstreetwealth.com or complete our online enquiry form for professional financial advice regarding pensions.

The content of this article is for information only and does not constitute formal financial advice. This material is for general information only and does not constitute investment, tax, legal or other forms of advice.

References to legislation and tax is based on our understanding of United Kingdom law and HM Revenue & Customs practice at the date of publication. These may be subject to change in the future. Tax rates and reliefs may be altered. The value of tax reliefs to the investor depends on their financial circumstances. No guarantees are given regarding the effectiveness of any arrangements entered into on the basis of these comments.

You should not rely on this information to make, or refrain from making any decisions. Always obtain independent, professional advice for your own particular situation.

Craven Street Financial Planning Limited is authorised and regulated by the Financial Conduct Authority.

Production

Production