During the latest Budget, the Labour Government announced that they intend to charge a further 2% income tax on savings and dividend income. There are two key dates for this being:

- 6th April 2026 – dividend income will attract a further 2% income tax

- 6th April 2027 – savings income will attract a further 2% income tax

They also intend to impose this charge on property income too but this article is intended to focus on savings income only.

This change applies to bank interest and dividends earned outside of tax-free wrappers like ISAs and pensions and your personal tax allowances, which are:

- Personal Allowance

- £12,570 if your total income is below £100,000

- Personal Savings Allowance (PSA)

- £1,000 for a basic rate taxpayer and £500 for a higher rate taxpayer (additional rate taxpayers receive no PSA)

- Savings Allowance

- £5,000 for low income individuals

The 2% increase will only affect the interest you earn above these tax-free allowances. For example, a basic-rate taxpayer with £1,500 of taxable interest would have the first £1,000 covered by their PSA, and the remaining £500 would be taxed at the new 22% rate (previously 20%) from April 2027.

There are two types of savings income which are the focus of this article:

- Interest income

- Dividend income

Interest income

This will include but not limited to:

- Bank interest

- Some National Savings & Investment (NS&I) savings

- Income from fixed interest securities (gilts and corporate bonds)

- Interest from unit trusts, OEICs and investment trusts which are not deemed as dividends

- Interest on purchased life annuity contracts

- Chargeable gains from life insurance contracts (such as single premium investment bonds)

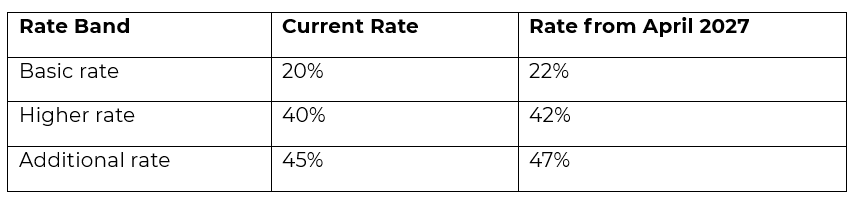

The table below sets out these tax rates:

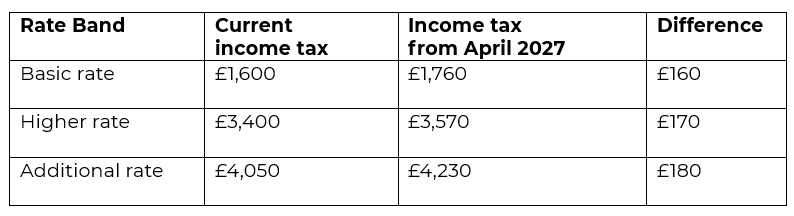

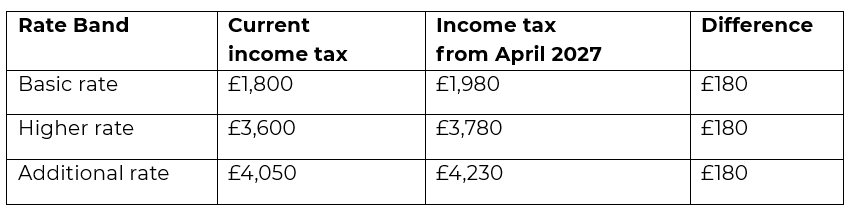

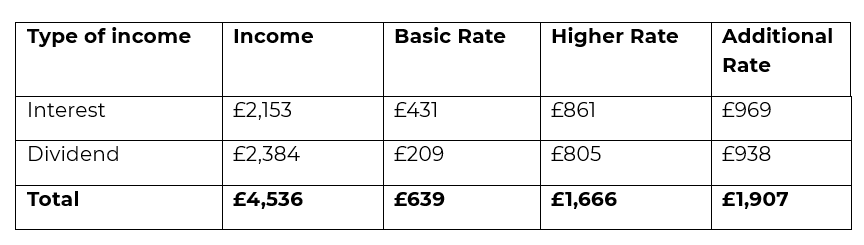

Let’s put some context around this. If you had £300,000 saved in the bank or invested giving you an interest income of, say, 3% a year this equates to £9,000. The following tables set down the position using this example:

Example 1a: Assuming all available PSA allowance is applied to this interest

Example 1b: Assuming PSA allowance has been used elsewhere

This assumes that no tax free allowances are available

Dividend income

Dividend income is a portion of a company’s profits paid to its shareholders as a reward for their investment.

You will typically see dividend income from an investment portfolio either managed by your stockbroker or independent financial adviser or directly held shares and investments. This would be invested into the stock market so capital is at risk and will move up and down.

Dividends held within ISAs or SIPPs are entirely tax free, while others must be reported for tax purposes.

You only pay tax on any dividend income above the dividend allowance (in the 2025/26 and 2026/27 tax years the allowance is £500).

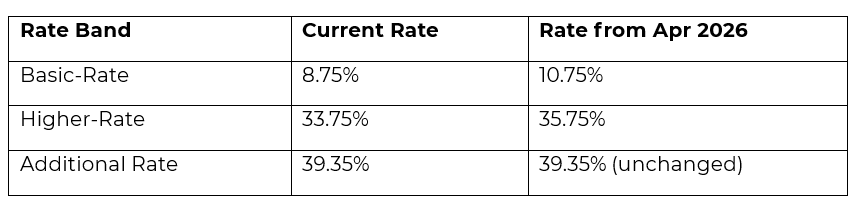

The table below sets out these tax rates:

Ways to avoid or reduce paying this extra tax charge on interest and dividend income:

- Use your ISA allowance. Any income inside an ISA is free from all types of income and capital gains taxes. For the 2025/26 and 2026/27 tax years the adult ISA allowance is £20,000 per individual and the Junior ISA allowance is £9,000 per child.

- Make a pension contribution. Any growth within a pension fund is free from income and capital taxes. Do liaise with your financial planner or accountant before placing any money into a pension as the pension input rules are complex.

- Venture Capital Trusts. These are high risk, illiquid and volatile products and you could lose your capital – please take advice before using these types of investments. Any dividends are exempt from income tax.

- Use of investment bonds. Any chargeable gain is subject to income tax and taxes are specific to the type of bond used (i.e. onshore or offshore) and your own personal income tax position. If you have an investment bond, it will be advisable to have this reviewed by your financial adviser before 5th April 2027 to ensure you are not missing an opportunity to extract the money before the income tax rise.

- Consider Investing. Dividend taxes are lower than interest income savings taxes. It is important to ensure that investing is right for you given the risks involved so liaise with a financial planner on this subject beforehand.

The impact of investing

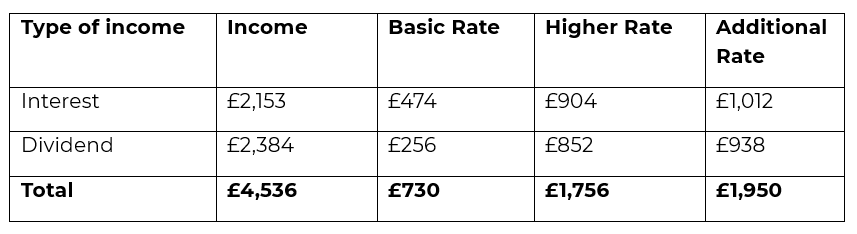

Again, let’s put some context around this. Using the same example set down earlier, if you had £300,000 invested into a General Account generating taxable income, I would typically expect to see the following taxes being paid on a portfolio of this type:

Current income tax rates

Income tax liability from April 2027

This assumes that no tax free allowances are available, the investor is balanced risk and seeking growth.

This shows that the following rises would be:

- £91 per year in tax for a basic or higher rate taxpayer

- £43 per year in tax for an additional rate taxpayer

Please note that this is a focus on tax on invested income only. Over the last 12 months (to 24th January 2026) the capital value of your portfolio would have risen by 13.74% (before charges) if invested into one of our balanced risk portfolios.

With tax increases on dividend and savings income due to take effect from April 2026 and April 2027, early planning may help reduce unnecessary tax. To review your arrangement and make the most of available allowances before these changes take effect, please contact us on 0330 320 9280, email info@cravenstreetwealth.com or complete our online enquiry form.

The content of this article is for information only and does not constitute formal financial advice. This material is for general information only and does not constitute investment, tax, legal or other forms of advice.

References to legislation and tax is based on our understanding of United Kingdom law and HM Revenue & Customs practice at the date of publication. These may be subject to change in the future. Tax rates and reliefs may be altered. The value of tax reliefs to the investor depends on their financial circumstances. No guarantees are given regarding the effectiveness of any arrangements entered into on the basis of these comments.

The value of investments, and any income from them, can fall as well as rise due to market, economic, or political factors. Past performance is not a reliable indicator of future results. You may not get back the original amount invested.

You should not rely on this information to make, or refrain from making any decisions. Always obtain independent, professional advice for your own particular situation.

Craven Street Financial Planning Limited is authorised and regulated by the Financial Conduct Authority (FCA). The FCA does not regulate tax advice.

Production

Production